When In Manila, no one likes lining up for anything. But every month, tens of thousands of Filipinos living abroad endure long lines at money transmitter services to send money to their relatives and friends living back in the Philippines. They’re frustrated by delays, relatively high transfer fees and the unnerving thought that their generosity might actually put their relatives in a risky situation. Given all the technology we’ve got today, shouldn’t someone have figured out how to make money transfers easier?

Someone has. “I send money back to my mom and dad in the Philippines once a month and now I’m doing it online using nTrust,” says nTrust Chief Architect, Rino Ong. His company has jumped at the opportunity to make peer-to-peer financing easier for those of us trying to stay connected with folks back home. Sending funds for day-to-day living, medical bills, dental expenses or anything else, has never been easier, safer, faster or more affordable.

Their innovative solution combines the ease of a peer-to-peer payment solution with the convenience of an online community.

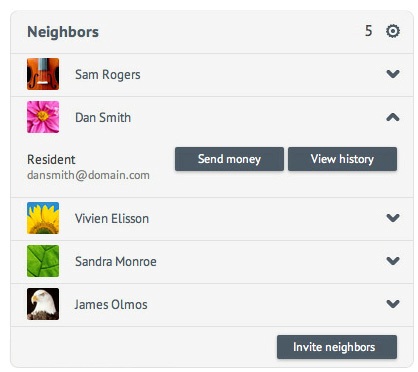

When you sign up for your free account and create your profile, you become a “Citizen of the nTrust Nation”. Then you can build a neighborhood, which is a real-life network of family and friends that are always available. It makes sending money fast and convenient.

This is what your neighborhood looks like…

Connecting with convenience is a big advantage for nTrust Developer, Randy Ordinario. He is known to send money back to the Philippines regularly for birthdays, medical bills, or small emergencies, “probably over 100 times already,” he says. “It’s fast and reliable and I can access the funds any time. It’s such a time saver.”

Here’s Randy, a developer at nTrust, and all-around nice guy.

Connect with convenience

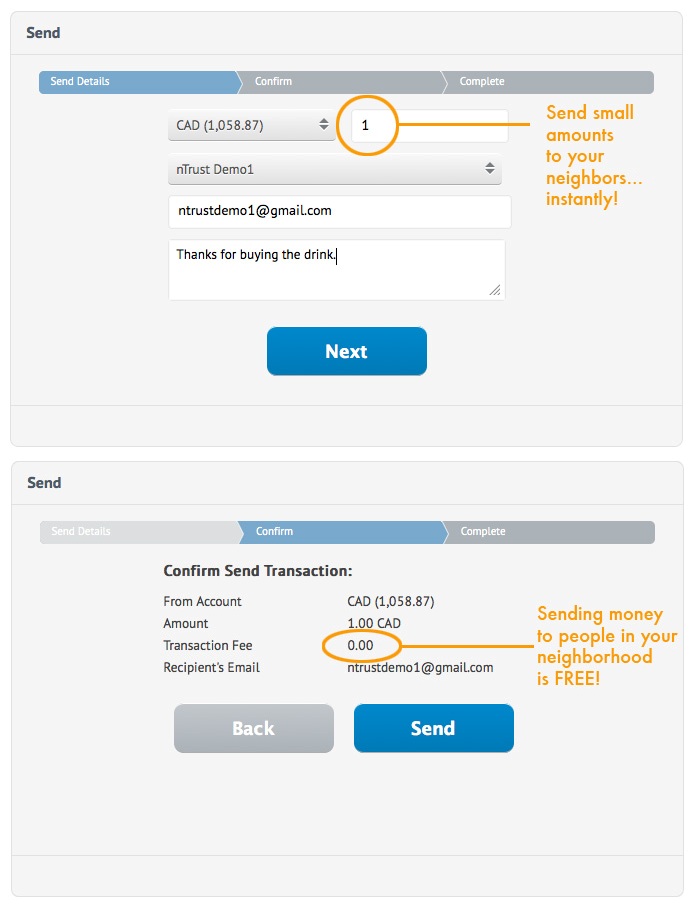

“I used to go into a Western Union shop to line up and send funds and I thought, ‘wouldn’t it be more convenient if I could just send this online?’” Ong says. With his family signed up on nTrust, the days of paying fees of twelve percent or more are over. He’s done wasting time in a lineup or wondering why the money he sent still hasn’t shown up in his parent’s account are over. He’s also no longer concerned about the safety of his parents when they go to pick up the money in the Philippines.

“It’s not something that you might worry about in North America, but in the Philippines and some other countries where remitting funds is common, thieves will prey on people after they pick up their money,” Ong says. “But with nTrust, you just take your card to the ATM and you don’t have to take out everything at once. You can use it like a credit card. And of course, the online transfer itself is instant and protected by bank-level security. That makes it safer.”

Send or receive money in a host of currencies, in any amount, at any time, anywhere on Earth… Instantly.

Ong and his colleagues are continuing to improve the nTrust platform based on customer feedback. “You could say we’re still in Beta, and we’re definitely listening to what the members of our community say they want. We’ve got a lot of feedback from Filipinos, who want to remit money to the Philippines. That is helping us build a platform that meets their needs.”

nTrust CEO Rob MacGregor first noticed the need for this type of service while traveling on business in the Philippines. “A small sum of money can go a long way in a lot of neighborhoods, but the trick is to get it there in a way that’s fast, safe, convenient, and lets the recipient keep more of the hard-earned money sent from overseas” he says. He realized that the tools for putting a solution together were already available thanks to the development of a generation that spends its time on the Internet. “This generation understands technology and has a higher comfort level with technology. They live their lives online.

If you’ve ever wondered how to transfer money to the Philippines, look no further. nTrust is the answer. It was built with safety in mind. We had to build a system that was to a higher standard than the security of the banks. Our citizens are sophisticated to know what to look for,” MacGregor says.

“Peer-to-peer financing to recipients in the Philippines involves deeply personal transactions. Our platform just helps you make use of the connections that are already there.”

How to Transfer Money To the Philippines with New Online Service