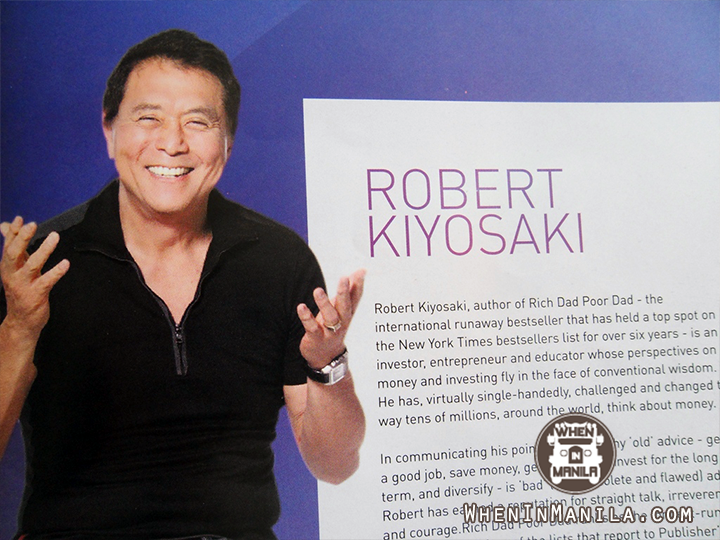

Last November 29, I went to Robert Kiyosaki Live in Manila. The 12-hour event included lots of speakers, but I want to zoom in on the three biggest things I learned from Robert Kiyosaki. (Check this article to learn more about the other speakers).

Photo by Dave V.

While I enjoy attending talks and workshops, I have never joined one that focused on making your money grow. Because of that, I don’t know much about financial literacy except for old-fashioned concepts I bet most readers have heard of by now. Interestingly enough, Robert Kiyosaki debunked most of them.

What I really appreciate about Robert Kiyosaki is how he challenged the usual conventions attached to career and money. More than casually brushing off these rules, he explains why and how you could break them. Here are three BIG rules you should consider breaking.

3.) Go to school.

On particularly hectic days in school, students find themselves sharing memes like these:

While I believe that school isn’t everything, I find memes like these to be too simplistic, and I often feel compelled to say this:

After all, there’s a much bigger picture that surrounds the stories of successful college dropouts like Mark Zuckerberg, Steve Jobs, and Bill Gates. I like how Kiyosaki expounded on his “school-isn’t-everything” approach by warning others about the potential perils of school–and not just simplistically discrediting schooling altogether.

Here are some of the ideas he brought up: An A+ student is conditioned not to make mistakes. (If you get mistakes in an exam, you get deductions.) When you ask for help during exams, it’s called cheating. When you blurt out the wrong answers, you’re called stupid. In many ways, we are rewarded when we have the answers and punished when we commit mistakes.

This kind of system presents numerous problems. Kiyosaki argues that you need to make mistakes in order to be rich. Also, even if you do know all the answers to the questions asked in school, this doesn’t guarantee that you’ll be rich or even financially independent upon leaving school. After all, most schools don’t even teach financial literacy.

So, instead of simply going to school, what does Robet Kiyosaki advise you to do? Study. Study about things that could make you rich—especially those things which are not taught in school. Be absolutely okay with not knowing all the answers. Be wary when you feel like you know all the answers. Most importantly, make mistakes.

2.) There’s only room for one at the top.

One more thing Kiyosaki warns about most school is how they teach you that emphasizes that there is only room for one person at the top. There’s only one topnotcher in each class, and only one valedictorian every graduation. Being #1 doesn’t leave room for others. The road to success then becomes a competition instead of a collaboration.

Kiyosaki emphasized the need to build strong teams. “Build a strong team around you and make sure that you study with them,” he said.

He once again juxtaposed the “rich dad” to the “poor dad.” The poor dad—”the academic genius who knew all the answers”—sat alone on his desk thinking of how to pay the bills. The rich dad conducted regular meetings with this teammates and solved problems with them. He had an attorney, a banker, a real estate agent and other people in his team. Together, they discussed and challenged each other’s ideas. That’s how he got smart; therefore that’s how he got rich.

The rich dad practiced getting smarter every day. The poor dad practiced having the answers every day.

1.) Live below your means.

Kiyosaki asked us, “Who has ever been told to live below your means?” I raised my hand. He looked at the crowd and shouted, “FUCK THAT IDEA…Life isn’t about that bullshit of living below your means and saving money.”

He encourages people to live the rich life, not to live below your means. Does this sound irresponsible and perhaps too good to be true? (After all, most of us have been taught to live below our means and to save money.)

He went on to explain assets and liabilities. “You can have everything you want if you buy assets first before liabilities,” he said. “We [Robert Kiyosaki and his wife] buy assets first. Then the assets buy my Ferraris…I may be Japanese, but I don’t look good in Toyota. I have two Ferraris. They’re beautiful. I look good in them.”

In his book, Kiyosaki defined assets: “an asset is anything that you acquire that puts money into your pocket. Assets are what the rich use to generate wealth over time. They come in many forms, including real estate, businesses that don’t require you to work at them, and stocks and bonds.” (Source)

So, yes, it is irresponsible to buy a Ferrari when you can’t afford it. But the idea of “saving money” and “living below your means” is limiting because they imply that what you could afford is a constant limiting factor that you can’t challenge.

Instead, Kiyosaki encouraged the audience to buy an asset that in turn would buy what you want. Don’t just accept the so-called reality that since you can’t afford what you want, you would just have to settle.

Photo by Dave V.

Overall, I’m grateful I got to watch Robert Kiyosaki live. I know you could get a wealth of information in reading his books–but it’s another experience to see him up close! It’s always interesting to attend events and read books that drastically challenge the way we think. After all, if we only come across ideas we already knew from before, how could we improve?

Robert Kiyosaki shared a quote from Einstein, which I think would best emphasize the importance of attending events like these and chasing after opportunities that challenge our beliefs: “We can not solve our problems with the same level of thinking that created them.”